Deconversion and Merger Services

Deconversion and Merger Services

Intellectual Dimensions (ID) is the leader in proactive deconversion and merger preparation, equipping Credit Unions to navigate current core system transitions with confidence as well as to fortify themselves for any future changes. Whether you’re actively undergoing deconversion now or looking to preemptively secure your data infrastructure, ID ensures you’re prepared every step of the way.

We provide solutions to safeguard and retain your historical data, ensuring it’s not just preserved but also primed for strategic use, regardless of your future core system choices.

Seamless Data Transition, Strategic Future Readiness

Core system conversion presents a unique set of challenges, notably the risk of losing invaluable historical data integral to your Credit Union’s operations and compliance requirements. ID recognizes the critical nature of your data and the complexities involved in ensuring its continuity beyond the current core system.

Benefits

Features

The ID Advantage

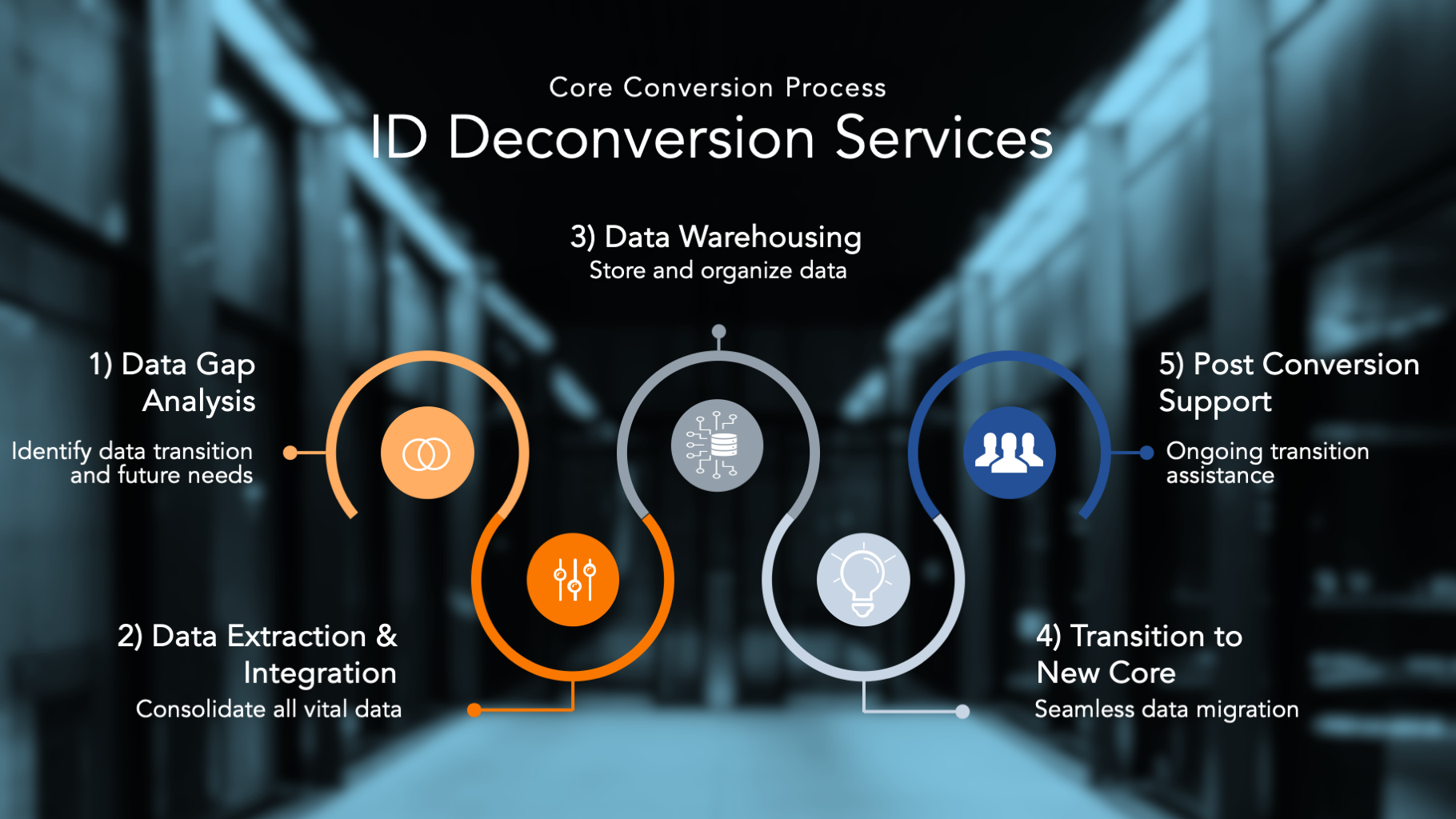

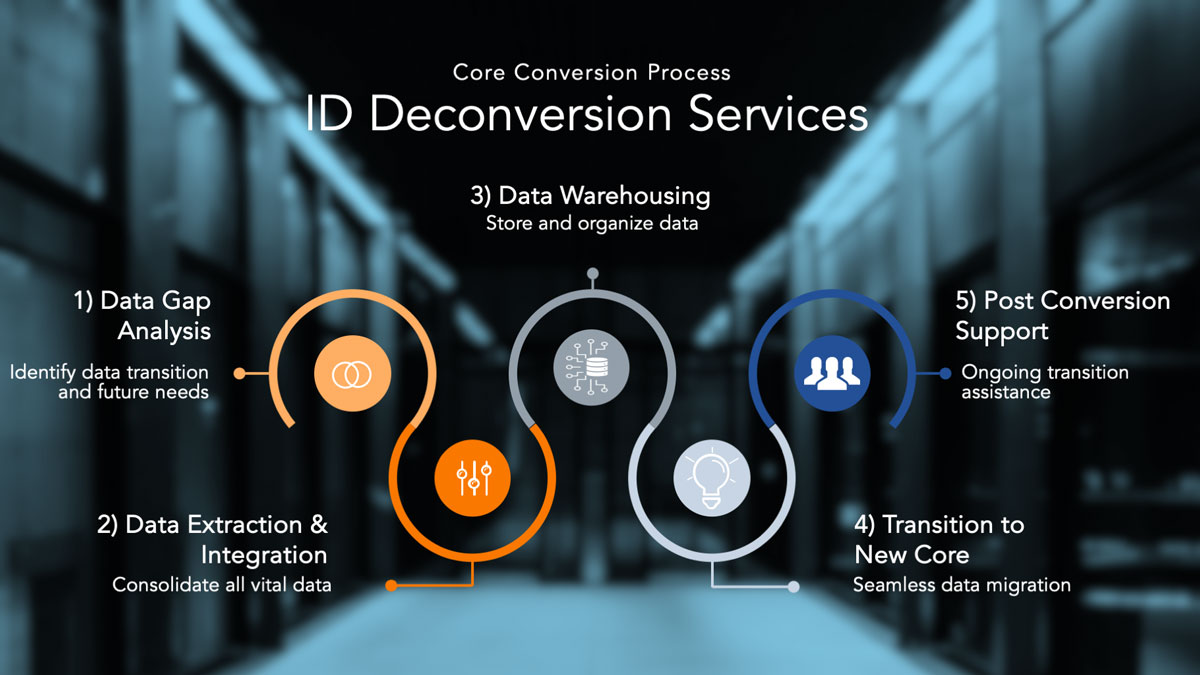

With ID’s Deconversion and Merger Services powered by VantEdge Point DataFusion™, we offer a proactive approach to deconversion. By starting the deconversion process now, we ensure that all data from your current core system is meticulously preserved, including the integration of third-party systems, setting a robust foundation for any future core conversions.

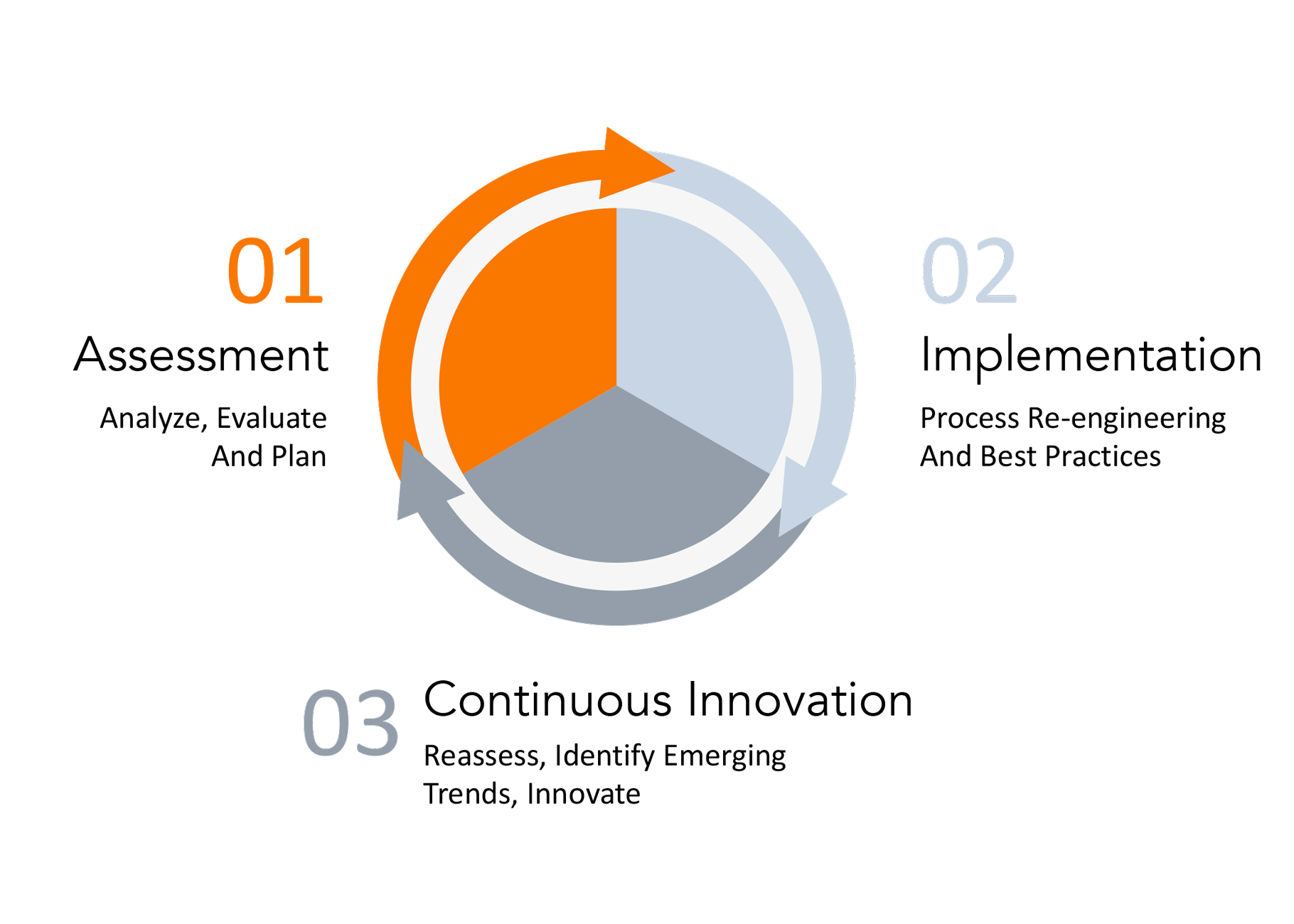

Cycle of Success: Your Blueprint for Deconversion Excellence and Beyond

Our approach to deconversion is guided by ID’s proprietary Cycle of Success methodology, a proven process that ensures comprehensive planning, execution, and follow-through for each deconversion project. This methodology encompasses a series of strategic steps designed to understand your specific needs, prepare your data landscape for transition, and implement solutions that align with your Credit Union’s long-term goals and current needs. With the Cycle of Success, we guarantee not just a successful deconversion but a foundation for ongoing innovation and growth.

ID Cycle of Success

Our Deconversion and Merger Services

As a key member of your Core Conversion team, ID focuses on the critical aspect of your Credit Union’s data integrity. We offer a robust suite of deconversion services that facilitate a smooth transition for Credit Unions shifting from legacy systems like XP2 and Spectrum to contemporary cores such as Symitar, Correlation, DNA, and others. Here are some of the many specialized services we provide:

Our approach is built on a foundation of experience across multiple core systems, demonstrating our capacity to adapt and apply our expertise regardless of the client’s starting or endpoint in the core landscape. Whether it’s facilitating a seamless transition or providing the temporary infrastructure needed for data management, ID is your partner in deconversion as well as strategic data empowerment.

“In today’s fast-paced financial world, Credit Unions face the challenge of seamlessly transitioning from one Core to another while maintaining operational efficiency and member satisfaction. With the help of Intellectual Dimensions, our Credit Union was able to face this challenge. Intellectual Dimensions possess a deep understanding of Credit Union operations and the intricate nuances involved in Core transitions. Their approach is not merely transactional; it’s a collaborative journey tailored to meet the unique needs of each Credit Union.

Deconversions can be daunting undertakings, but with Intellectual Dimensions by your side, the process becomes manageable and even transformative. They go above and beyond to ensure a smooth transition. They help with guidance, troubleshooting challenges, and providing unwavering support from start to finish.

With Intellectual Dimensions at your side, you can navigate the Core transition with confidence, knowing that you have a trusted ally committed to you for a successful conversion.”

Secure Your Data’s Future Now with ID

Don’t wait until it’s time to convert to a new core system. With ID’s Deconversion and Merger Services, begin the journey to data empowerment today. Preserve your historical data, integrate your systems, and pave the way for a strategic future.

With ID, deconversion is not an end but a strategic step towards a data-empowered future. Let us safeguard your past and unlock the potential of your Credit Union’s tomorrow.

Your Data, Your Future, Our Expertise

Deconversion & Merger Case Studies

Discover the practical benefits and successful results of our deconversion and merger services through three case studies, showcasing our ability to ensure smooth data transitions and enhance operational efficiency:

Problem/Need:

As part of a merger/conversion, the Credit Union needed to:

- Identify and resolve duplicate information between platforms (e.g., member numbers, TINs).

- Stage data for loading into test and production systems.

- Test, balance, and validate each load in the test system and on the live day.

Solution:

The data warehouse was utilized to ingest data from the merging system while the primary core system was already using the warehouse. This process included:

- Identifying duplicate information by performing a match and kill operation between data from both core systems.

- Staging data for loading into the surviving core in the required format.

- Performing multiple test loads into the test system to validate, balance, and verify data integrity.

- Utilizing validation and test plans, including automated comparisons between the two systems, to ensure data accuracy.

- Loading the validated data into the production system on the live day.

Additional Benefit:

The ability to perform extensive testing and validation ensured smooth live days/weekends for multiple mergers and conversions, reducing the risk of data discrepancies and ensuring seamless transitions. This approach minimized downtime and disruption, allowing for continuous operation and member service throughout the process.

Problem/Need: The need for this case study was based on multiple data moves needed during a five-week timeframe:

- Send all available data related to residential mortgages to a servicer in a specified format

- Send all available data related to commercial loans to a servicer

- Provide balancing information for shares and loans to the acquiring core processor

Solution: We used the warehouse to send required files to servicers and balancing information to the new core. These processes were repeated multiple times prior to each live date, ensuring the smoothest possible data transitions on the live days/weekends. Additionally, as each data run was validated, the opportunity to correct erroneous core information and add missing data to the core allowed for the most “clean” and comprehensive data possible.

Additional Benefit: After extracted data had been moved from the old core to the new core, it was discovered that some shared branch and batch transactions had been posted to the old core in error. We were able to isolate and identify these transactions in order for them to be posted to the new core.

Problem/Need: The core system to which a Credit Union was converting preferred to perform the data movement via server-to-server communications, rather than by receiving delimited files. Additionally, resources from the core being left were extremely limited.

Solution: We built an infrastructure that allowed the Credit Union and the new core to complete the deconversion process without any assistance or expense related to traditional, and often outdated, deconversion programs from core systems.

Additional Benefit: The reduced expense, faster turnaround times, and unlimited frequency of producing data for test runs all contributed to a positive conversion experience.