Credit Union Intelligence

Why Credit Union Intelligence?

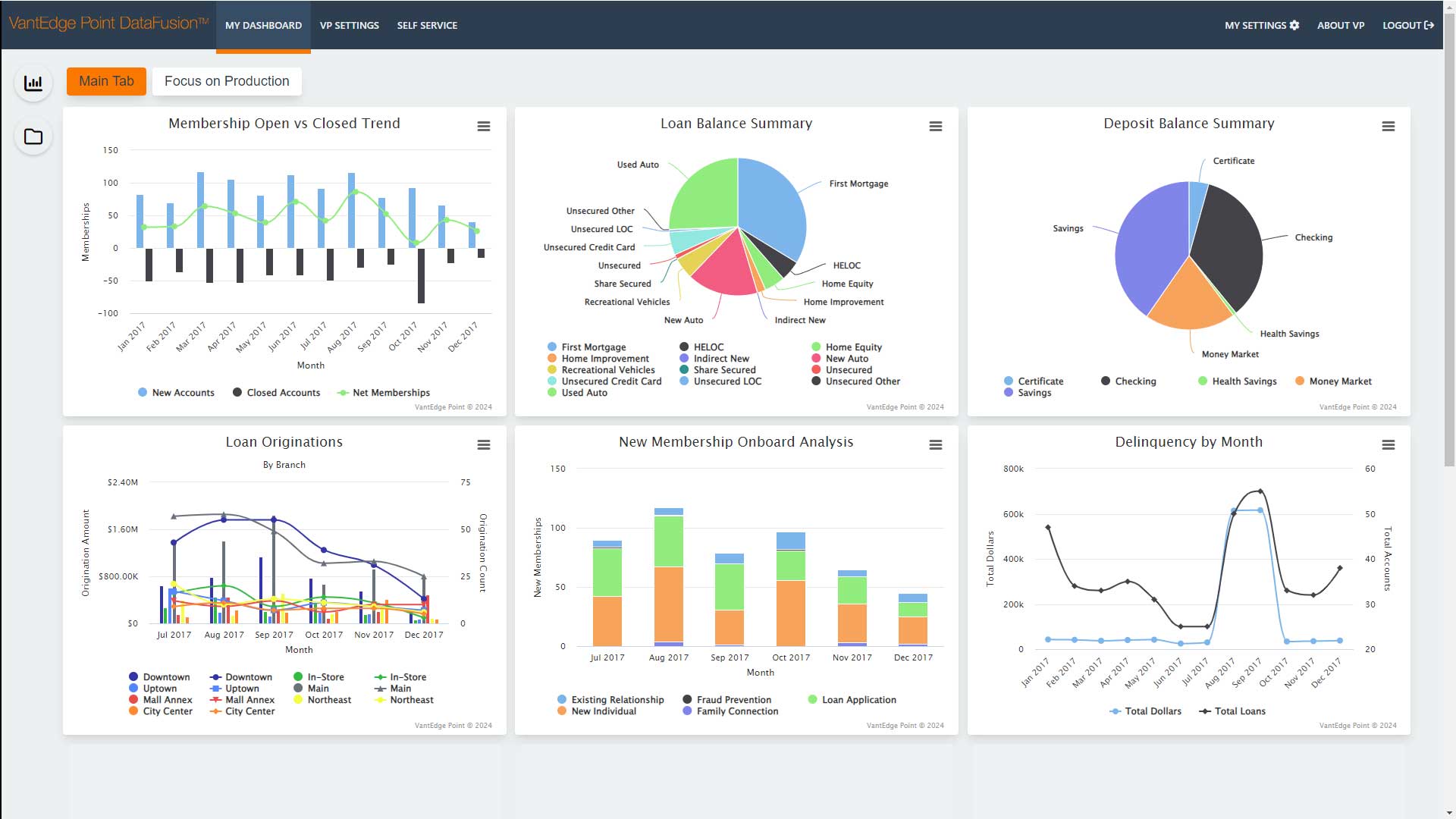

Credit Union executives recognize the necessity of leveraging business information to manage key performance indicators, member relationships, employee performance, and membership loyalty. Credit Union Intelligence (CUI) transforms data from all sources within your Credit Union into actionable insights, helping you identify opportunities, drive change, improve efficiency, and support strategic goals.

What Does A Credit Union Intelligence Solution Offer?

A robust Credit Union Intelligence solution provides:

- Reliable and Accessible Data: Ensuring data is consistent, understandable, easily accessed, and timely.

- Proactive Management: Transitioning from reactive to proactive management, defining future strategies, goals, and tactics.

- Enhanced Decision-Making: Delivering executive decision-making information.

- Opportunity Identification: Analyzing products and activities to identify opportunities.

- Member Engagement Evaluation: Assessing member engagement levels.

- Relationship Monitoring: Detecting relationship recessions.

- Operational Efficiency: Improving operational efficiency and performance.

- Real-Time Performance Tracking: Plotting productivity against goals in real-time.

The Key To Credit Union Intelligence Success

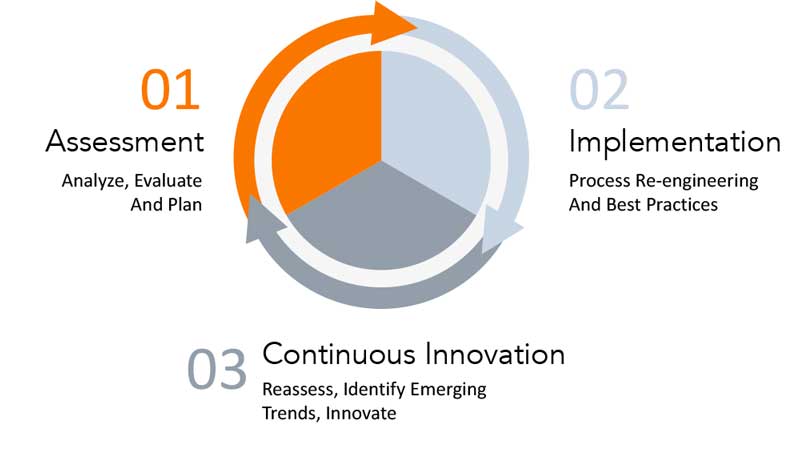

Successful Credit Union Intelligence solutions help Credit Unions gain comprehensive knowledge of and insight into the factors that affect their overall performance. The success of our Credit Union Intelligence implementations is the focus that we place on understanding the vision, goals, and strategic objectives of the credit union to create a ‘top down – bottom up’ approach. This approach, lead by your executive team, supports the goals and strategies important to your credit union along with enhancing daily processes and real-time management and decision-making.

Our approach creates a clear understanding of how Credit Union Intelligence can benefit your credit union and be embraced by your entire management team. Credit Union Intelligence is a powerful solution when instituted with a well-organized plan.

CU Intelligence Lifecycle

How CU Intelligence Can Help Your Credit Union

To illustrate the tangible benefits of our Credit Union Intelligence solutions, here are some real-world examples of how we’ve helped credit unions transform their operations, drive growth, and enhance member satisfaction.

Problem/Need:

A Credit Union wanted to email new members within 15 to 30 minutes of membership opening.

Solution:

Implemented live data loads every 15 minutes to identify newly opened memberships. The data was then sent to an email distribution software to populate templates and send emails to new members. The emails included information about the newly opened membership, available products, and next steps.

Additional Benefit:

Expanded the process to update the ATM/Debit platform with restrictions and limits for new memberships. Restrictions are automatically lifted after a designated time through another automated procedure.

Problem/Need:

The Credit Union wanted to establish a Member Loyalty Program to classify members based on product usage and possession, including third-party products, and automate the delivery of tailored member benefits.

Solution:

The solution leveraged comprehensive data warehousing to classify members accurately. This classification incorporated data from multiple sources:

- Core banking data detailing member account and transaction histories.

- Data from home banking, credit card, and mortgage vendors to capture a holistic view of member interactions and product usage.

- The loyalty classifications were then used to programmatically apply rewards directly within the core systems. This included:

- Applying rate bonuses and refunding fees.

- Waiving costs associated with gap insurance and warranties.

- Adjusting check hold limits and remote deposit caps in both the core system and associated ATM/Debit platforms.

To ensure real-time accuracy, member status and progress within the loyalty program were loaded daily into the core system. This allowed front-end staff to access and communicate up-to-date loyalty information to members effectively.

Additional Benefit:

In addition to financial benefits for members, the Credit Union enhanced its communication strategies by integrating loyalty status updates into regular communications through Home Banking and Statement vendors. This integration ensured members received personalized updates about their loyalty status and available benefits, enhancing engagement and satisfaction.

Problem/Need:

A Credit Union Lending Manager needed to address internal conflicts regarding the cherry-picking of loans among processors and underwriters.

Solution:

Developed a loan processing pipeline/dashboard that refreshed data hourly. This tool allowed the manager to manage loan flow and address staff issues related to loan processing times.

Additional Benefit:

Inspired a branch manager to use the same process for managing cash flow within the branch, eventually rolling out the cash monitoring process to all branches.

As part of a merger/conversion, the Credit Union needed to:

- Identify and resolve duplicate information between platforms (e.g., member numbers, TINs).

- Stage data for loading into test and production systems.

- Test, balance, and validate each load in the test system and on the live day.

Solution:

The data warehouse was utilized to ingest data from the merging system while the primary core system was already using the warehouse. This process included:

- Identifying duplicate information by performing a match and kill operation between data from both core systems.

- Staging data for loading into the surviving core in the required format.

- Performing multiple test loads into the test system to validate, balance, and verify data integrity.

- Utilizing validation and test plans, including automated comparisons between the two systems, to ensure data accuracy.

- Loading the validated data into the production system on the live day.

Additional Benefit:

The ability to perform extensive testing and validation ensured smooth live days/weekends for multiple mergers and conversions, reducing the risk of data discrepancies and ensuring seamless transitions. This approach minimized downtime and disruption, allowing for continuous operation and member service throughout the process.